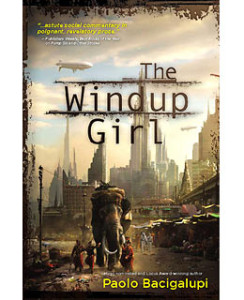

I want to briefly rave about my favorite character from one of my favorite books – Anderson Lake of The Windup Girl. (with the caveat that I haven’t read the book since it came out a few years ago, so the details are slightly fuzzy)

I want to briefly rave about my favorite character from one of my favorite books – Anderson Lake of The Windup Girl. (with the caveat that I haven’t read the book since it came out a few years ago, so the details are slightly fuzzy)

I recently compared the game Forbidden Island to modern corporate capitalism. “Drawing all the value you can from a system that’s collapsing around you before abandoning it and fleeing to the next area of opportunity.” And I mentioned how exciting that is, and that it’s the basic psychology behind a lot of action movies/books.

If you could take this economic cycle and turn it into a human being, you would have Anderson Lake. He is corporate capitalism personified. Despite commanding great resources and living in luxury, he is always right on the edge of ruin. He must always take drastic measures and make gambles to stay alive. Every single time a risk presents itself, the situation he is in plays out thusly:

“The course of action I’m being presented with is dangerous. There is a fair chance that I will fail, and if I do I will most likely die immediately. But my only other option, doing nothing, results in dying anyway. So why the fuck not? It’s not like things can get worse…”

And when things do go wrong, his next-most-viable option is generally something more risky and with even worse consequences for failure. Not only will he die, but there’ll be collateral damage, or people he loves will be hurt, or so on.

Here’s the really perverse thing though – he can never assure sustainable survival by his actions. All he can do is push off his inevitable death & follow-up crisis by a few months.

This is exactly the situation corporations find themselves in all the time. Any corporation that isn’t continually profitable is dissolved. So the monomaniacal focus, out of sheer survival drive, is to ensure the next quarter is profitable and who gives a fuck about anything else? Corporations cannot plan for the long term prosperity of the human race, they’re in a tooth-and-nail struggle just to stay un-cannibalized for a few more months, constantly.

That’s Anderson Lake. His only goal is the next quarter. Nothing else matters, because if he doesn’t survive it nothing else will.

Of course inevitably his luck runs out. It’s the stupidest little thing that gets him, but that’s the point – you make enough gambles and you’re bound to lose one. But what choice did he have?

I wrote in Sympathy for the Devil that my job isn’t clear-cut for me anymore, a lot of it is confusion, and desperate hunting for data and reasons. For at least a year now I’ve been convinced that I’m going to utterly fail at something, everyone will see how much I suck at this, and I will lose my job. It’s gotta happen eventually. It’s led to a new mentality for me. It’s turned me into Anderson Lake.

The big crush of work comes at the end of every quarter. If I can survive that, I have a job for the next three months. So every three months my only goal becomes “Survive this quarter-close process.” I’m more willing to take risks that I might not otherwise (which isn’t actually very risky in the grand scheme of things, when all I do is juggle numbers on a spreadsheet, but it’s still not things I like doing), because either I take the risk and fail and lose my job, or I don’t take the risk and lose my job anyway. Might as well have a chance of riding this for another three months.

It’s also made me slightly more aggressive in regards to salary – I’m trying to get as much socked away as I can before the roof comes crashing down, so I go for the short-term gain. I want the number that the unemployment office uses as it’s base to be as high as possible when this thing runs out, so that’s become a worrying big concern.

Corporate America – you get stuck inside it for long enough, and it’ll warp you into a sick mirror of itself.

This seems specific to a certain type of company.

Mainly one without much capital. If the company is just a hundred people in a rented office (which it sort of sounds like yours is), then liquidating just causes you to lose a bit of institutional knowledge. So that risk looms over you for every unprofitable quarter.

It looks a bit different in companies that own land and buildings and machines and cars and trucks and stakes in other companies, etc.

Those can sometimes lose money for years on end and still turn everything around again. It’s much more worthwhile to plan long-term. Obviously, at some point even those companies can go down. Though it often only happens after they’ve been bleeding for over a decade. (CEOs lose their jobs more quickly in those situations, so their incentives might be a bit different.)